Latest Search

Quote

| Back Zoom + Zoom - | |

|

SFST Visits Toronto, Calling on Firms to Develop Wealth Mgmt & Family Biz in HK

Recommend 1 Positive 4 Negative 2 |

|

|

|

|

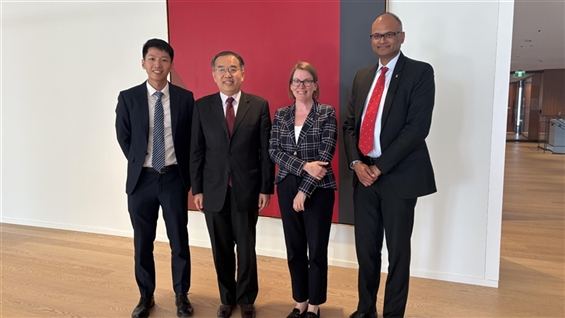

Christopher Hui, Hong Kong's Secretary for Financial Services and the Treasury (SFST), has started his five-day visit to Canada. His first stop was Toronto, where he met with representatives of two banks and an insurance group immediately after his arrival in the city. Upon his arrival in Toronto, Hui started his itinerary with a meeting with the Group Head, RBC Wealth Management, Neil McLaughlin, and Executive Vice President and Global Head, Strategy, Products and Digital Investing, Stuart Rutledge, of the Royal Bank of Canada. He then proceeded to Scotiabank to meet with its Group Head for Global Wealth Management, Jacqui Allard, and Vice President, Strategic Cultural Segments, Amit Brahme. Hui shared that Hong Kong is currently the largest cross-border wealth management hub in Asia, and some anticipate that Hong Kong will leap into first place globally by 2028. The family office business is an important segment of the asset and wealth management sector in Hong Kong. As of end-2023, the size of private banking and private wealth management business attributed to family offices and private trusts clients reached USD185.2 billion, providing huge business opportunities for the asset and wealth management sector and other related professional services. Hui also highlighted the diversity of financial products in Hong Kong and the latest passage of the stablecoins legislation, providing investors with numerous investment options. The banks were encouraged to utilize the developmental strengths of Hong Kong's asset and wealth management industry and establish their presence in Hong Kong. AAStocks Financial News |

|