Latest Search

Quote

| Back Zoom + Zoom - | |

|

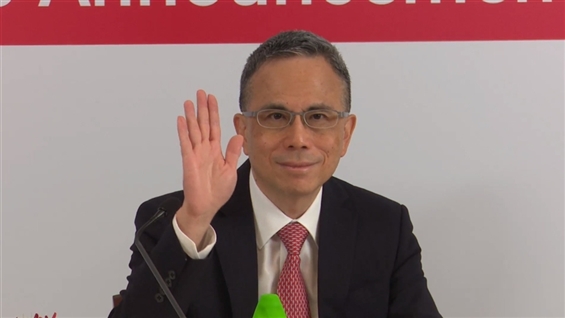

Victor Li: CKI To Definitely Invest in HK if Any Project Offers Reasonable Return

Recommend 9 Positive 15 Negative 4 |

|

|

|

|

CKI HOLDINGS (01038.HK) held its annual general meeting (AGM), at which Chairman Li Tzar Kuoi, Victor said CKI is a global infrastructure group, with international business being its root. Emotionally speaking, he has special feelings for Hong Kong as it is his home. Therefore, if there is any project in Hong Kong that can generate reasonable return, CKI will definitely invest in it. As Hong Kong is an international financial center (IFC), more and more international enterprises and international family offices in the city will mean heightened consolidation of its position as an IFC, and its economic fundamentals will be refined, which is conducive to long-term development. Li also mentioned the acquisition of two new projects in a month, emphasizing that the Group never chooses any particular country as an investment location. He considered Phoenix Energy, a natural gas network company just acquired, to be a high-quality regulated asset that can provide stable cash flow and immediate returns, apart from sustained recurring profits. The new solar energy project, UU Solar, will also entail immediate returns, recurring profit contribution and stable cash flow to the Group. Asked about CKI's single-digit profit growth last year, Li answered that the Group's net profit added by 12% YoY last year, excluding the one-off gain from the sale of part of Northumbrian Water in 2022, with cash flow from operations reaching a record high of $8.6 billion. He boasted about CKI's resilience, with its investment portfolio comprising mostly regulated businesses, providing a solid contribution despite the macro-economic shocks, and the solid performance of its non-regulated businesses. On CKI's prospects, Li talked about CKI’s strong financial fundamentals, and its distinctive advantage is that there are more potentials to explore new opportunities in a volatile economy. CKI had a cash position of $13 billion at the end of last year, with a net debt-to-total net capital ratio of 7.7%, which remained at a similar level even after the acquisition of the new gas network company. This put the Group in a good position to seek growth opportunities and meet challenges. In addition, the Group will explore new investment opportunities in the global de-carbonization sector as part of its overall business development strategy. AAStocks Financial News |

|