Latest Search

Quote

| Back Zoom + Zoom - | |

|

<HK Property>HANG LUNG Ronnie Chan: Home Prices in HK/ GBA To Converge Somewhat, Not Necessarily Bad for HK's LT Competitiveness

Recommend 17 Positive 25 Negative 25 |

|

|

|

|

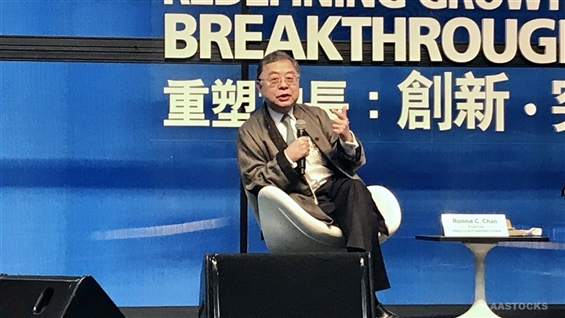

Ronnie Chan, Chairman of HANG LUNG PPT (00101.HK), wrote the Chair’s Letter to Shareholders in the Company's 2023 Annual Report. Inasmuch as he expected the company's luxury retail properties in Mainland China would continue to perform nicely in the coming many years, the same cannot be said of Hong Kong’s residential and commercial real estate. In Hong Kong, the decade-long artificial shortage of land for home building is on its way to being broken. With expected ample supply, apartment prices cannot repeat the leaps and bounds of yesteryears. In the long haul, it will help Hong Kong’s competitiveness. Hong Kong’s commercial properties may undergo a downward adjustment in rents because the city's economy has nor been vibrant. Given increasing physical connectivity with the Greater Bay Area (GBA) north of the border, many of Hong Kong citizens will not hesitate to take the short train ride there to spend money on weekends. As more consumer dollars migrate north, sales transacted in Hong Kong will decline. Hong Kong's rents will fall, leading to lower asset value and even an expansion of the cap rate. Hong Kong property prices and those of the GBA will, over time, converge somewhat. It is inevitable, and is not necessarily bad for Hong Kong’s longer-term competitiveness. AAStocks Financial News |

|